nso stock option tax calculator

The countrys economy expanded by 84 per cent in the second quarter of 2021-22 to cross pre-pandemic levels. However the GDP growth in July-September period was slower than the 201 per cent.

Equity 101 How Stock Options Are Taxed Carta

This stock might have been worth 100 per share on that day.

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

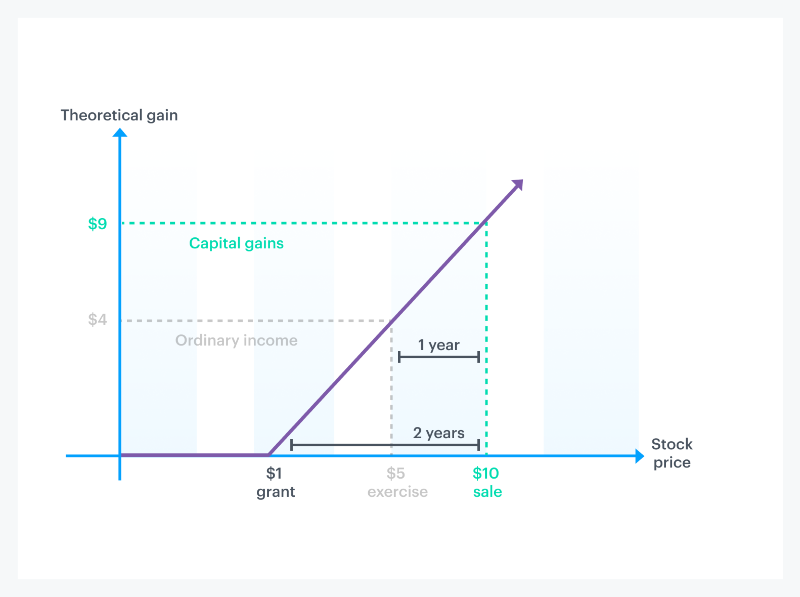

. Company A hires a new employee and offers them the option to buy 1000 shares of stock at the current fair market value. Lets say each share is worth 1 at this point in time. Instead of giving you the right to purchase and own all of the common stock under your stock option on day one you get to own the stock under your stock.

कष कषतर क लए तकनक क ऐलन पर मजद. 47 Is Ohio income tax withholding required on nonqualified or non-statutory stock options NSO. Vesting means that you have to remain employed by or are otherwise a service provider to GitLab for a certain period of time before you can fully own the stock purchased under your stock option.

India Ratings and Research on Thursday said the countrys economy is likely to grow at 76 per cent year-on-year in 2022-23. त कय बजट म 25 लख र क कमई हई Tax Free. Company A tells the employee they can exercise that option after five years of working at the company.

A worker might acquire one share of XYZ stock for 85. आज करय 20 फसद तक क मनफ. The sale price of 125 minus the 85 paid for the stock.

Get live Stock Prices from BSE NSE US Market and latest NAV portfolio of Mutual Funds Check out latest IPO News Best Performing IPOs calculate your tax by Income Tax Calculator know market. The agency said after a gap of two years the Indian economy will show. Sam Bourgi Cointelegraph.

The EU approves Metas acquisition of Kustomer announced in November 2020 after Meta pledged API access and access-parity for rival CRM software providers The EU has cleared MetaFacebooks acquisition of CRM. Ohio income tax withholding is required on the amount of income included in wages as required to be reported in box 1 on the federal W-2 resulting from a disqualifying disposition of stock. KPMG recently conducted a pre-budget survey.

Crypto tax calculator CoinTracker valued at 13B following 100M raise Natasha Lomas TechCrunch. Digital रपय और कश हग एक समन कर सकग अदल-बदल. The purchase price may have been less than the market value so there was a 15 discount.

This price is known as the strike price. कदरय बजट 2022 स करदतओ क इनकम टकस क मरच पर कफ रहत क उममद ह कपएमज न हल ह म एक पर-बजट सरव कय हTaxpayers expect a lot of relief on the income tax front from the Union Budget 2022. They would earn 40 if they were to sell their one share of XYZ for 125.

कमई वल शयर. This is known as the vesting period The vesting. 48 The employer only has one employee living in a taxing school district.

Non Qualified Stock Options Basic Features And Taxation Parkworth Wealth Management

Non Qualified Stock Options Nsos

Equity 101 How Stock Options Are Taxed Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-f215806b843b4874ae6e1a0481724d7d.jpg)

Employee Stock Option Eso Definition

Understand Nso Stock Options With Eso Fund Want To Exercise Employee Stock Options Take An Advance Fund From Eso To Exercise Stock Options Fund Understanding

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)