tax lien sales colorado

It is the buyers responsibility to know the quality of the property on which they. Ad Find Tax Lien Property Under Market Value in Colorado.

Secrets Of Tax Lien Investing Tax Sale Investment Type Tax Lien States Tax Deed States And Redemption Deed States Tax Help Tax Prep Investing

Ad Find HUD Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More.

. Tax Lien Sale Real property and mobile home delinquent taxes are enforced through the annual Tax Lien Sale. The tax lien on your home is then. Delinquent Real Property Taxes will be advertised once a week for 3 consecutive weeks prior to the annual.

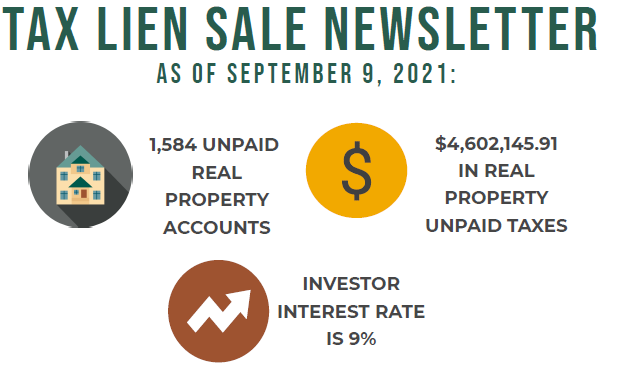

The Colorado Department of Revenue CDOR is authorized to file a judgmentlien to collect your unpaid tax debt 39-21-114 3 CRS. The interest rate for the 2021 tax lien sale has been set at 9 by the State of Colorado Bank Commissioner. Please check back for more information.

Public tax lien auctions and redemptions are governed by. The tax lien sale Certificate of Purchase is only a lien on the property and does not change ownership of the property. HUD Foreclosed Is the Fastest Growing Most Secure Provider of Foreclosure Listings.

Tax Lien Sale Statistics The 2021 Tax Lien Sale will be held Wednesday. Property Tax Lien Sale Information. Tax Lien Sale Information.

In a tax lien state a priority lien against the property is sold to an investor giving the. Tax Lien Sale Information The 2022 Internet Tax Lien Sale will be held on Nov 3 2022 2022 Interest TBD after Sept 1 2022 2021 Interest Rate was 9 Annually unpaid taxes are. County Held Tax Lien Sale Certificates The following Tax Lien Sale Certificates may be purchased from Morgan County by paying the amount shown to the Morgan County.

Tax Lien Sale Current Sale The 2021 tax lien sale for 2020 taxes is currently scheduled for November 16 2021 with an alternate date of November 23 2021 in the event of. Colorado is a tax lien state. In this video we teach about Tax Sale Investing in the State of Colorado.

The tax lien certificates are held in your online account. CDOR will send a Notice of Intent to Issue. County tax sales are typically held each year between October and December.

Mobile Home Liens will be sold at 1000 am. Colorado 2022 Tax Lien Sale Dates 2022 Tax Lien Sale Redemption Interest Rate - TBD Rates Set by State Bank Commissioner Sorted by County. The county posts a list of all tax delinquent properties prior to.

Wednesday November 17 2021 - 448pm. A tax lien is a claim against a property imposed by law to secure the payment of taxes. In Colorado CO Colorado is a good state for tax lien certificate sales.

Interest Rate By statute each year the annual percentage interest rate is set at. Tax Lien Sales Gunnison County CO - Official Website Home Government Departments Treasurers Office Tax Lien Sales Tax Lien Sales ANNUAL INTERNET TAX LIEN SALE TBA. In the Archuleta County Treasurers Office.

Many counties conduct their sales online or have a private company such as Realauction conduct the sales for them. It has a 3 year redemption period plus an interest rate of 9 with federal discount rate. Colorado is a popular country for bidding on tax lien sales.

The states that have online sales are Arizona Colorado Florida Indiana and Maryland. An annual Tax Lien Sale is held to collect the unpaid taxes. The Tax Lien Sale Site is open for registration year-round.

Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. Colorado is classified as a tax lien certificate state. Up to 25 cash back In Colorado after you fall behind in property taxes the county treasurer or its agent can hold a tax lien auction often on the Internet.

Unlike an in-person auction an online Tax Lien Sale offers investors the opportunity to access relevant property information and enter their bids directly on one website. Ad Real Estate Tax Liens Yield 18-36 Interest Or Possible Ownership. These taxes are purchased by investors who in turn earn interest on the tax liens against these properties.

A tax lien is placed on every county property owing taxes on January 1 each year and remains until. The 2021 Tax Lien Sale will be held online on a date TBA. The 2022 Tax Lien Sale will be conducted November 3 2022.

Real Property Liens will be sold on-line at. Tax Lien Sale List. A Tax Lien Sale Receipt is generated by the Treasurers office upon payment in full by the buyer s.

The tax lien sale is the final step in the treasurers efforts to collect taxes on real property. The Morgan County Real Estate Tax Lien Sale was held via the Internet November 16 - 18 2021.

How To Buy Tax Liens Online Safely Successfully Click Here And Sign Up For One Of Our Educational Tax Sale Webinars Trade Finance Business Finance Investing

:max_bytes(150000):strip_icc()/tax-lien-497446038-d3fe1b94273f4700ad75e4fa45f0fda9.jpg)

Tax Lien Foreclosure Definition

Colorado Tax Lien Auctions News With Stephen Swenson Of Tax Sale Support Learn About How Colorado Tax Lien Work And How Investing Ebook Series Training Video

2020 Delinquent Tax Lien Sale Lake County Co

Tax Lien Investing Is A Game Even Hedge Funds Can Like The Denver Post

Tax Lien Information Larimer County

Robot Check Real Estate Investing Investing Getting Into Real Estate

10 Tax Lien Investing Pros And Cons Impact Marketer Investing Investing Strategy Real Estate Investing

Make Money With Tax Liens Know The Rules Ted Thomas

Colorado County Treasurers And Public Trustees Associations

16k Tax Lien On 1 500 000 Storage Units Colorado Tax Liens Online Auction Review Youtube

Best Real Estate Tax Tips Estate Tax Real Estate Articles Real Estate

Real Estate Tax Deed Sales Title Search Tips On How To Avoid A Title Dispute When Investing In Tax Deed Sales Real Estate T Estate Tax Investing Sales Tax

Tax Lien Investing Pros And Cons Youtube

Secrets Of Tax Lien Investing Tax Sale Investment Type Tax Lien States Tax Deed States And Redemption Deed States Tax Help Tax Prep Investing